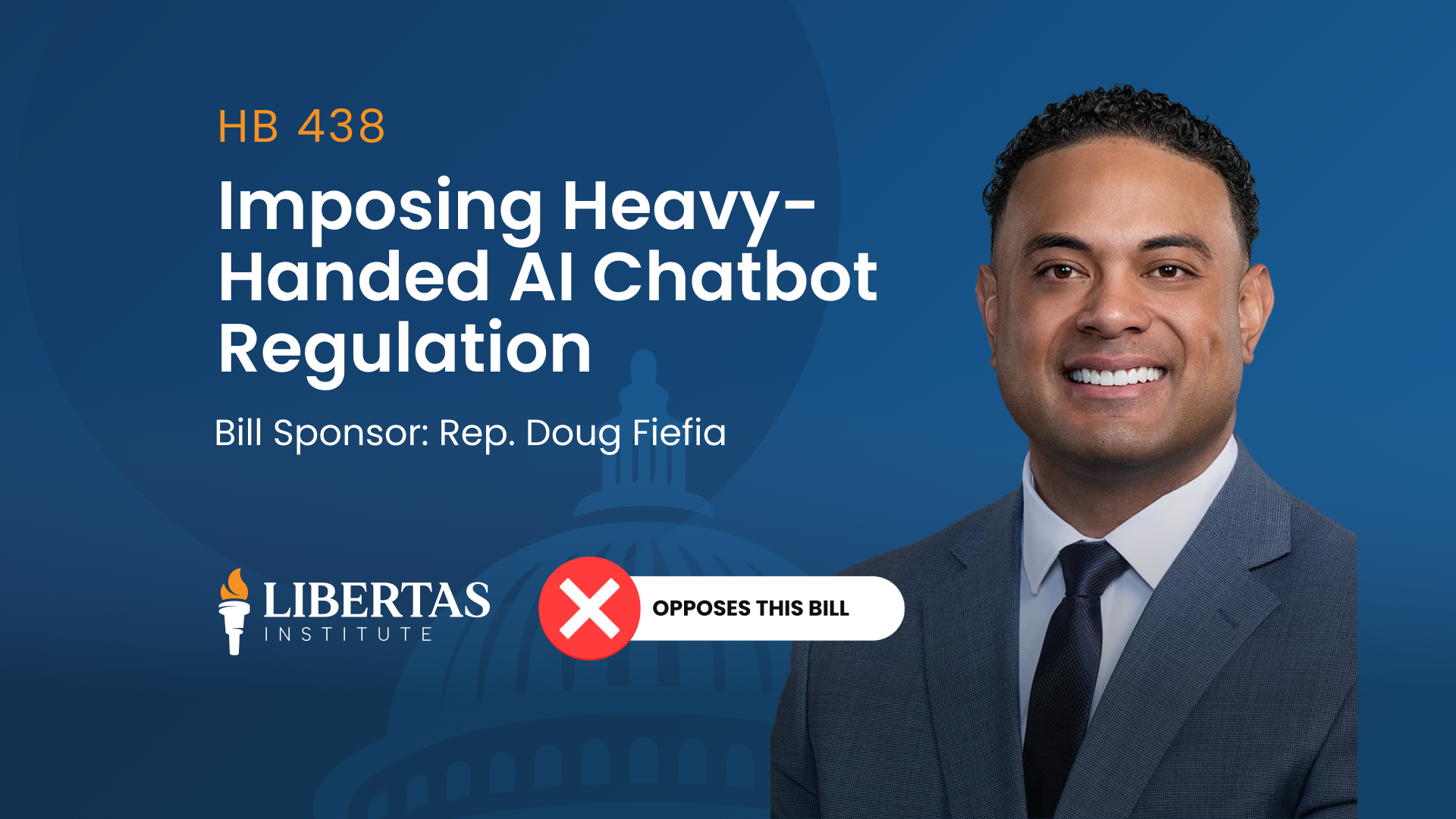

This bill passed the House 54-20 and did not receive a vote in the Senate. Libertas Institute opposes this bill

For several years, Representative Paul Ray has sponsored legislation to enact a heavy tax on electronic cigarettes and their supplies. This year, the bill is House Bill 252.

HB 252 would assess an 86% tax on electronic cigarettes, the liquid they use, and other nicotine-based products that are not approved by the FDA as a nicotine replacement therapy.

The first $2 million in taxes each year will be allocated to county health departments for enforcement of e-cigarette laws and prevention education for minors about tobacco and nicotine. The remaining money will be deposited into the General Fund to be appropriated for any purpose desired by the Legislature.

The bill also enacts new regulations for obtaining a permit to sell an alternative nicotine product or one that is not for therapeutic purposes.

While minors should be discouraged from consuming nicotine or developing other addictions, the responsibility for that education lies with parents and community organizations, not the government. It is wrong to so heavily tax e-cigarette users—especially those trying to stop smoking cigarettes—and compel them to finance this educational project and general governmental support with an 86% tax.