This bill passed the house with a vote of 63-4 and was not voted on in the Senate.

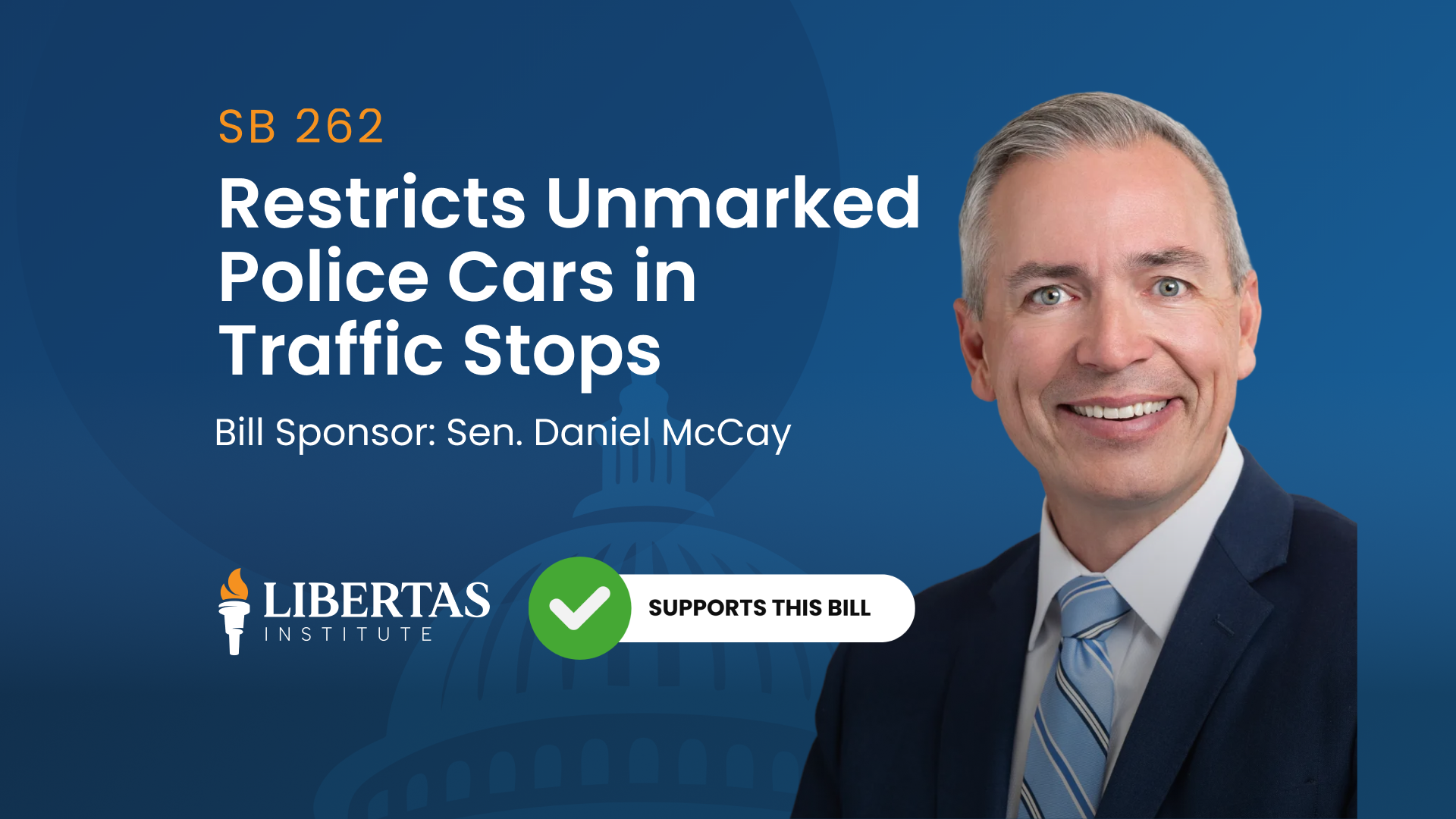

Libertas Institute supports this bill

Utah is one of only 13 states that taxes social security payments as income. Social security, unlike welfare, is an earned benefit by those who work and contribute to the program, and not given to everyone. While working, workers are already taxed to pay for their social security contribution and for Utah to tax the income post-retirement is akin to double taxation on the state’s part.

Unfortunately exempting Social Security from income tax would cost the state approximately $127 million annually, causing short-term budgetary problems for the legislature. Though it would be ideal to absolve most seniors of the responsibility of paying state income tax on their social security benefits, the legislature is making a small step forward in the right direction.

Representative John Westwood’s House Bill 276 exempts seniors whose adjusted gross income is made of social security benefits by 50% or more. Retirees who have a hard time dealing with rising costs due to their fixed incomes would be provided a non-refundable tax credit equal to 5% of the social security benefit.

HB 276 is an important first step to future expansion of this tax credit that would promote financial security and self-reliance for seniors who have structured their retirement to depend upon these promised payments.