This bill passed its first committee but did not receive a vote by the full legislature. Review our tracker for more information.

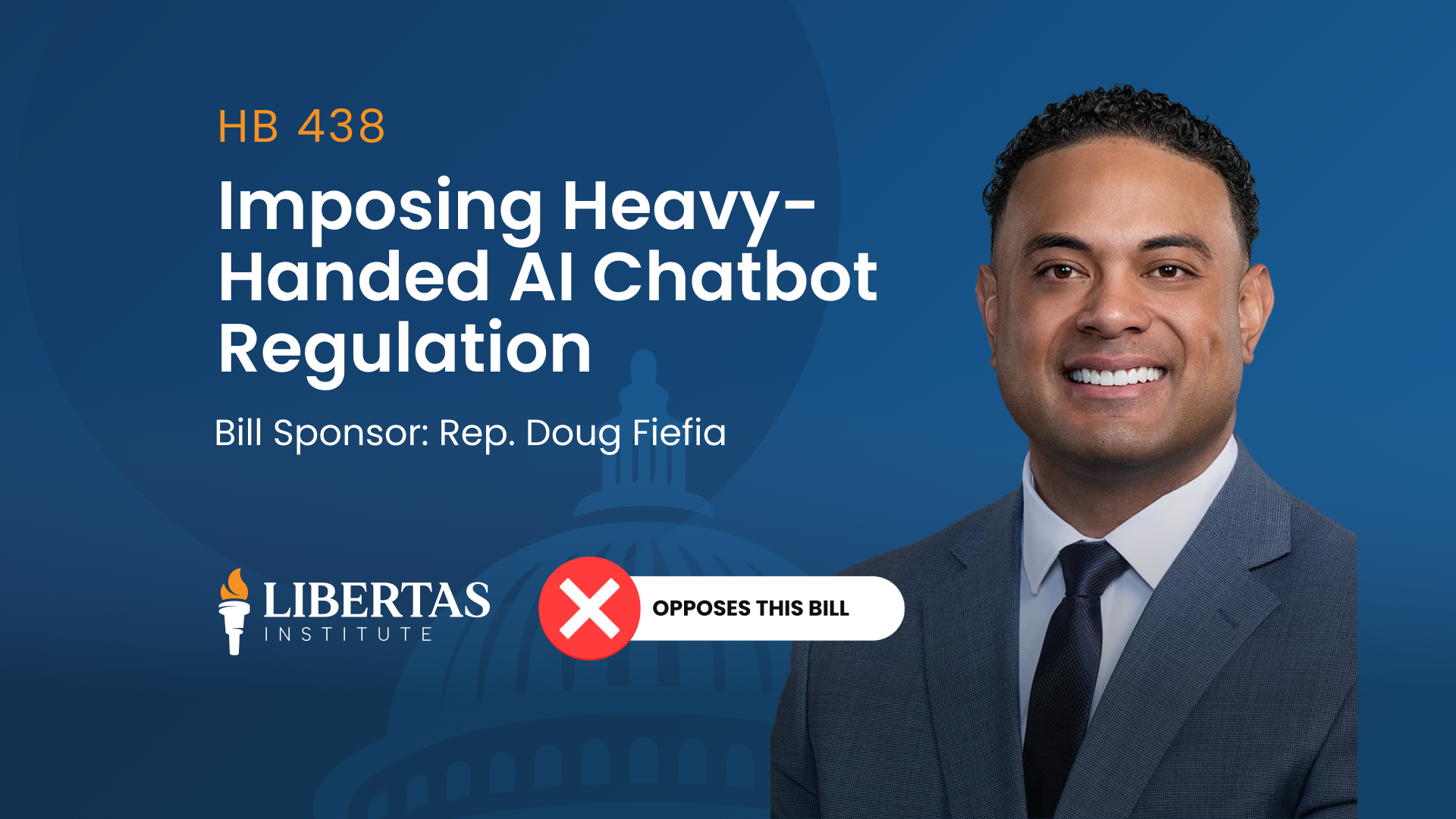

Libertas Institute opposes this bill

State legislation passed during the 1990s and early 2000s enables cities and counties — with voter approval — to add an additional 0.10% sales tax on certain goods with the revenue to be spent on zoos, recreation, arts, and parks.

Cities and counties use different acronyms for the ZAP/RAP tax, but the process and end result is the same. City and county governments put the tax before the voters on ballots, and if it passes, sales taxes go up, and a new fund is created. Sometimes these tax increases get the approval of voters, and sometimes they don’t.

State law also provides that the tax must be renewed by the voters every ten years. However, Senate Bill 255, sponsored by Senator Ron Winterton, would amend the renewal process to bypass the voter approval provision.

Libertas supports the provision that ZAP/RAP tax increases and renewals get approval from the voters and, therefore, urges a no vote on the bill.